Insurance For Valuable Jewelry Collections for Beginners

When men and women listen to about boy or girl life insurance procedures with adaptable phrases, they typically pause and ponder if it actually is sensible to consider insurance policy so early in everyday life. I get it, for the reason that childhood looks like a time that ought to be carefree, playful, and much away from monetary arranging. Still, everyday living contains a funny way of unusual us, and planning in advance can come to feel like planting a tree that provides shade later. These insurance policies are certainly not about anticipating the worst, but about making ready properly. They're able to supply peace of mind, lasting value, and a security net that grows along with your child. When you think about it, offering your son or daughter a money Basis early can truly feel like giving them a head begin in a long race.

Certainly one of the largest causes dad and mom consider boy or girl existence coverage procedures with flexible terms may be the adaptability they offer. Daily life changes continually, like a river that in no way flows the exact same way 2 times. Adaptable terms suggest you are not locked into rigid principles that no longer healthy Your loved ones problem. You may perhaps get started with a modest plan and alter it later as your earnings grows or as your child reaches new milestones. This flexibility can really feel like having a jacket that also matches regardless if the weather modifications. As an alternative to scrambling to regulate later, you have already got choices crafted into your coverage from the beginning.

Yet another angle value Checking out is how these insurance policies can lock in insurability in a younger age. Youngsters are typically healthy, and that could perform in your favor. With little one everyday living insurance procedures with adaptable terms, you regularly secure protection right before any health concerns crop up. Visualize it like reserving a seat at a well known exhibit in advance of it sells out. Afterwards in life, if your child develops well being ailments, they should have access to protection which could normally be highly-priced or restricted. This aspect by yourself might be comforting for fogeys who would like to shield their youngster long run choices.

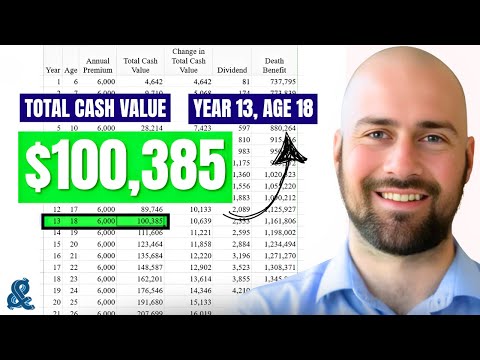

Persons also look at the savings part That usually includes youngster lifestyle insurance policy insurance policies with versatile terms. Although not each individual coverage is effective exactly the same way, some Make cash benefit eventually. This can experience just like a quiet savings account increasing from the qualifications while you give attention to daily life. Through the years, that dollars price may very well be employed for education, setting up a company, or dealing with unexpected expenditures. It isn't about acquiring rich quickly, but about continual growth. Like watching a plant expand, it demands patience, but the long run payoff is usually significant.

The Buzz on Tenant Insurance For Furnished Apartments

There is certainly also an emotional side to consider. Deciding upon kid daily life insurance policies procedures with adaptable conditions may give dad and mom a sense of Management in an unpredictable environment. Parenting usually looks like juggling a lot of balls simultaneously, and getting one a lot less get worried can make a huge change. Realizing you have put one thing in place for your son or daughter future can convey a peaceful feeling of aid. It is similar to buckling a seatbelt, not as you expect an accident, but since you value security and preparedness.

There is certainly also an emotional side to consider. Deciding upon kid daily life insurance policies procedures with adaptable conditions may give dad and mom a sense of Management in an unpredictable environment. Parenting usually looks like juggling a lot of balls simultaneously, and getting one a lot less get worried can make a huge change. Realizing you have put one thing in place for your son or daughter future can convey a peaceful feeling of aid. It is similar to buckling a seatbelt, not as you expect an accident, but since you value security and preparedness.Some critics argue that oldsters ought to focus by themselves insurance policies very first, and that time just isn't Improper. Nevertheless, baby life insurance guidelines with flexible conditions don't have to compete with Grownup coverage. Rather, they're able to enhance it. Visualize Your loved ones fiscal strategy for a puzzle, wherever each piece has its position. Adult coverage covers profits substitute and house stability, when kid insurance policies concentrate on long term protection and possibility. Alongside one another, they can make a far more finish photograph that supports The full family.

A different important aspect is affordability. Lots of mother and father are shocked to understand that boy or girl everyday living insurance policy procedures with versatile conditions can be comparatively affordable. Starting up early normally means lower rates, which may healthy much more simply into a month-to-month price range. It truly is like purchasing a ticket early and spending a lot less than in case you waited until the last second. Eventually, Individuals tiny payments can add nearly important Positive aspects. This affordability makes it easier for households from various monetary backgrounds to take into consideration this feature.

Flexibility also extends to how long the policy lasts. Baby life insurance plan policies with versatile conditions may perhaps enable conversion to adult insurance policies afterward. This characteristic can feel just like a bridge in between childhood and adulthood, making certain continuity of coverage. When your child grows up, they may not want to begin from scratch. As a substitute, they could have ahead a coverage which has been with them For several years. This continuity is often Specifically beneficial throughout early adulthood, when finances may be tight and priorities are still forming.

Mother and father often talk to if these guidelines are truly necessary. That issue is purely natural, and The solution depends upon private values and goals. Youngster lifestyle insurance policies policies with adaptable conditions are certainly not a one size matches all Option. For many households, they make ideal feeling, while others could choose different procedures. What issues is understanding the choices and making an educated choice. It is actually like picking out the suitable tool for the career. You would like something which matches your preferences, not exactly what Anyone else is utilizing.

Education scheduling is yet another place the place these insurance policies can play a task. Some mother and father use the money value from boy or girl lifetime insurance policies guidelines with flexible conditions to assist fund college or university or training courses. Although it must not replace other training savings designs, it could possibly function an extra useful resource. Consider it being a backup generator that kicks in when necessary. Obtaining a number of solutions can lessen worry and provide adaptability when big fees arrive.

There's also the idea of instructing economical responsibility. By putting together youngster lifestyle insurance policy policies with adaptable phrases, mothers and fathers can later involve their youngsters in comprehending how the plan works. This can be a gentle introduction to monetary concepts like preserving, curiosity, and long term planning. It is comparable to instructing a Learn The Latest Quickly youngster the way to ride a motorcycle, commencing with instruction wheels and steering. After a while, they get self confidence and understanding that can serve them perfectly into adulthood.

From the chance administration perspective, these policies give defense from exceptional but devastating gatherings. No mum or dad desires to think about getting rid of a child, but getting youngster existence insurance coverage procedures with versatile terms may help protect healthcare expenditures, funeral fees, or day without work perform If your unthinkable comes about. It is far from about putting a selling price on the daily life, but about decreasing economical pressure through an presently distressing time. In that feeling, the plan functions similar to a cushion, softening the affect of a hard drop.

Getting My Affordable Insurance Plans For Self Employed Workers To Work

Some family members also appreciate the predictability these procedures convey. With baby daily life coverage procedures with flexible terms, you frequently know What to anticipate when it comes to rates and Added benefits. This predictability might make budgeting less difficult and minimize surprises. Lifestyle is currently full of unknowns, so possessing just one spot that feels stable might be comforting. It is actually like possessing a trusted clock about the wall, usually ticking at precisely the same pace.Cultural and private beliefs also Enjoy a job in how people today perspective child everyday living insurance guidelines with adaptable terms. In some families, setting up forward is deeply ingrained, while others prefer to give attention to the current. Neither technique is inherently wrong or right. What issues is aligning your decisions with the values. If you think in creating a safety net early, these policies can align nicely with that mindset and aid your long term eyesight for All your family members.